Create your own insured portfolio using several Tools.

First ,To install, just use pip :

pip install pyinsuranceRequired Dependencies are listed below , such :

| Dependency | Version |

|---|---|

| arch | 5.0.1 |

| numpy | 1.20.1 |

| scipy | 1.6.2 |

| statsmodels | 0.12.2 |

| numba | 0.52.1 |

| setuptools | 60.5.0 |

| pandas | 1.2.4 |

There is no dependency verification , so please, make sure to have installed every required one before using the package.

Example

To begin, let’s extract some included default data :

import pyinsurance

from pyinsurance.pymolder import tipp_model

from pyinsurance.data.IRX import load as d1

from pyinsurance.data.sp500 import load as d2

import matplotlib.pyplot as plt

risky_Asset = d2()

safe_Asset = d1()/52 #we divided by 52 as we use weekly ratesLet’s initalise our first insured portfolio now!

For instance,we set our lock-in rate , minimum capital risk allocation , threshold for capital injection , allocate funds ,strategy’s percentage floor ,multipler,benchmark returns and rebalancement cycle being respectively equal to :

lock_in_rate = 0.05

mcr = 0.40

tfci = 0.80

fund = 100

floor = 0.80

multiplier = 10

Benchmark_return = risk_Asset

Rebalancement_frequency = 52 # once a week -> 52 weeks a yearRunning the tipp_model class :

res = tipp_model(risk_Asset,safe_Asset,lock_in_rate,mcr,tfci,fund,\

floor,multiplier,risk_Asset,Rebalancement_frequency)Our strategy-insured backtest is ready !

import matplotlib.pyplot as plt

from pyinsurance.Metric_Generator.returns_metrics import Cumulative_ret

fig = plt.figure(figsize=(15,5))

ax0 = fig.add_subplot(111)

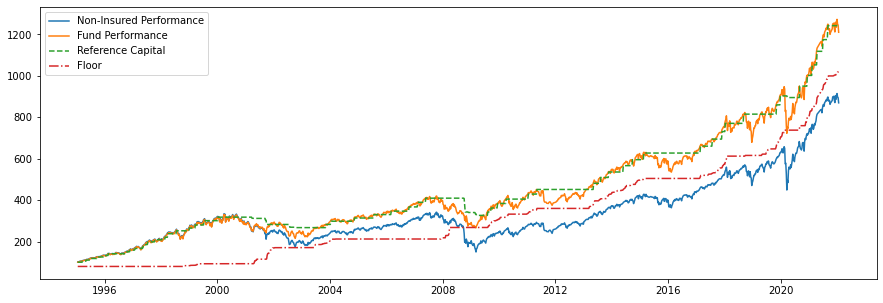

plt.plot(risk_Asset.index,Cumulative_ret(risk_Asset)*100,label = 'Non-Insured Performance')

plt.plot(risk_Asset.index,res.Fund,label = 'Fund Performance')

plt.plot(risk_Asset.index,res.Reference_capital,label = 'Reference Capital',linestyle="--")

plt.plot(risk_Asset.index,res.floor,label = 'Floor',linestyle="-.")

plt.legend()

plt.show()And our capital injections through the period are presented as:

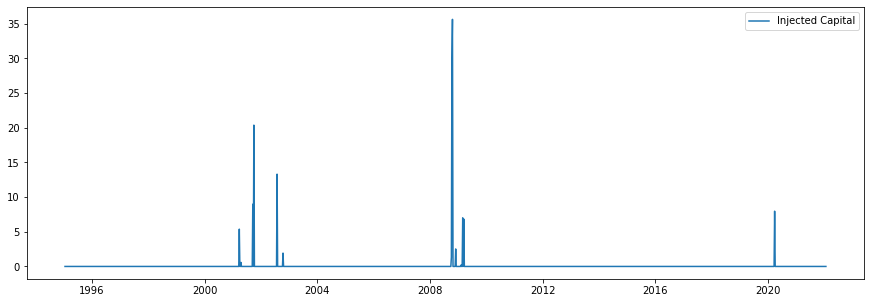

fig = plt.figure(figsize=(15,5))

ax1 = fig.add_subplot(111)

plt.plot(risk_Asset.index,res.capital_reinjection,label = 'Injected Capital')

plt.legend()

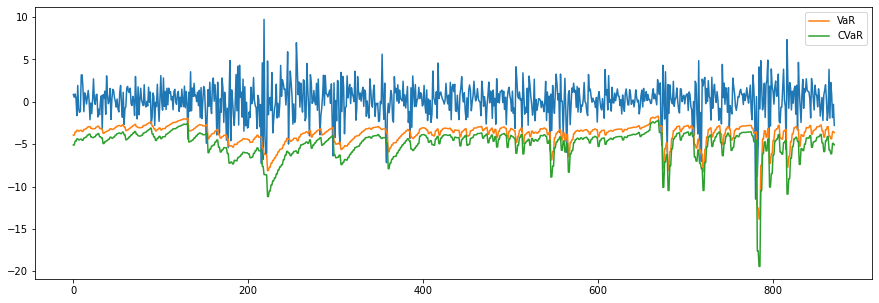

plt.show()If you want to backtest the VaR, you can use the varpy library: